Fast, Easy, Reliable 360°

Crypto Tax Reporting

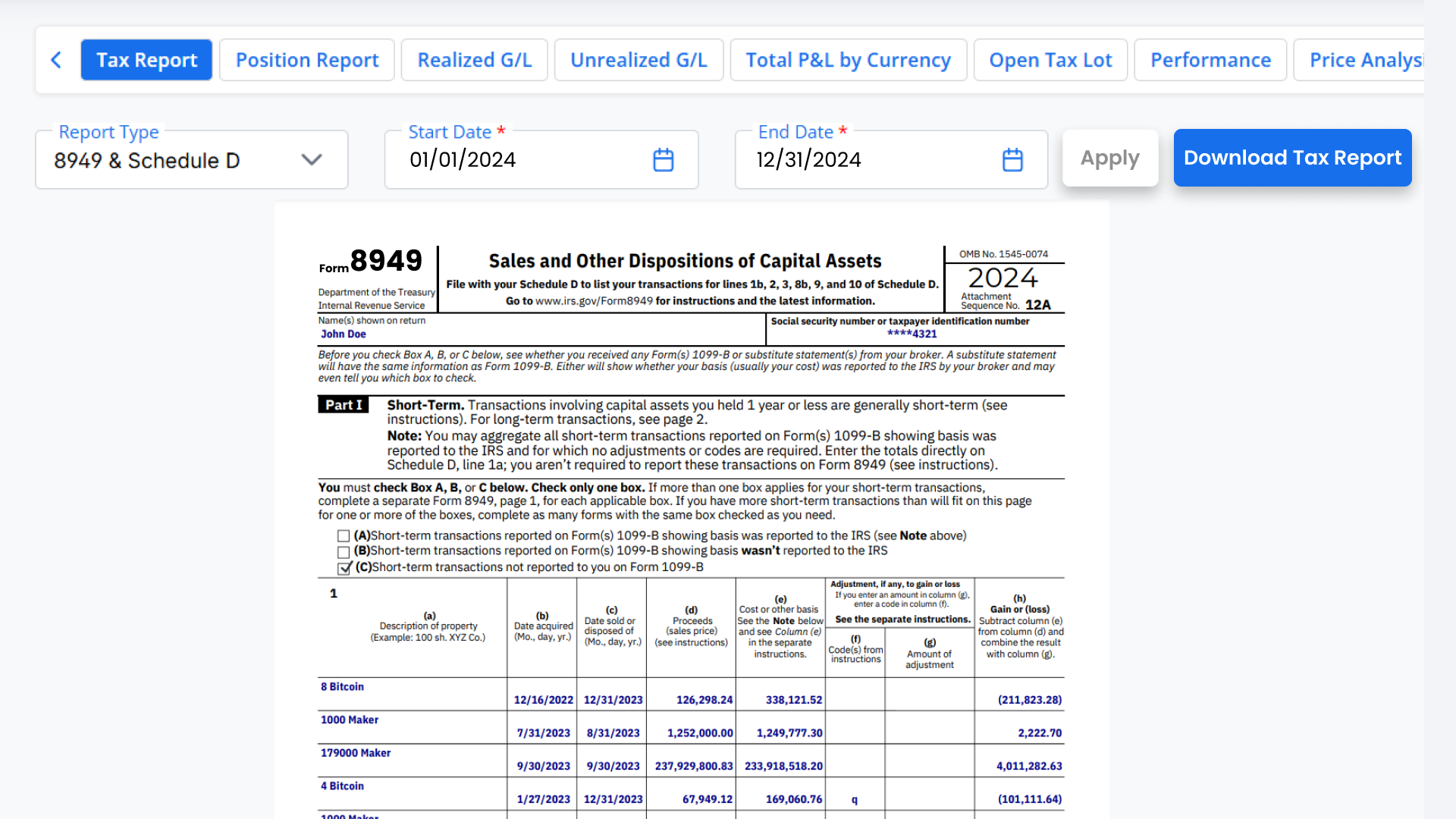

- Instantly generate Form 8949 & Schedule D.

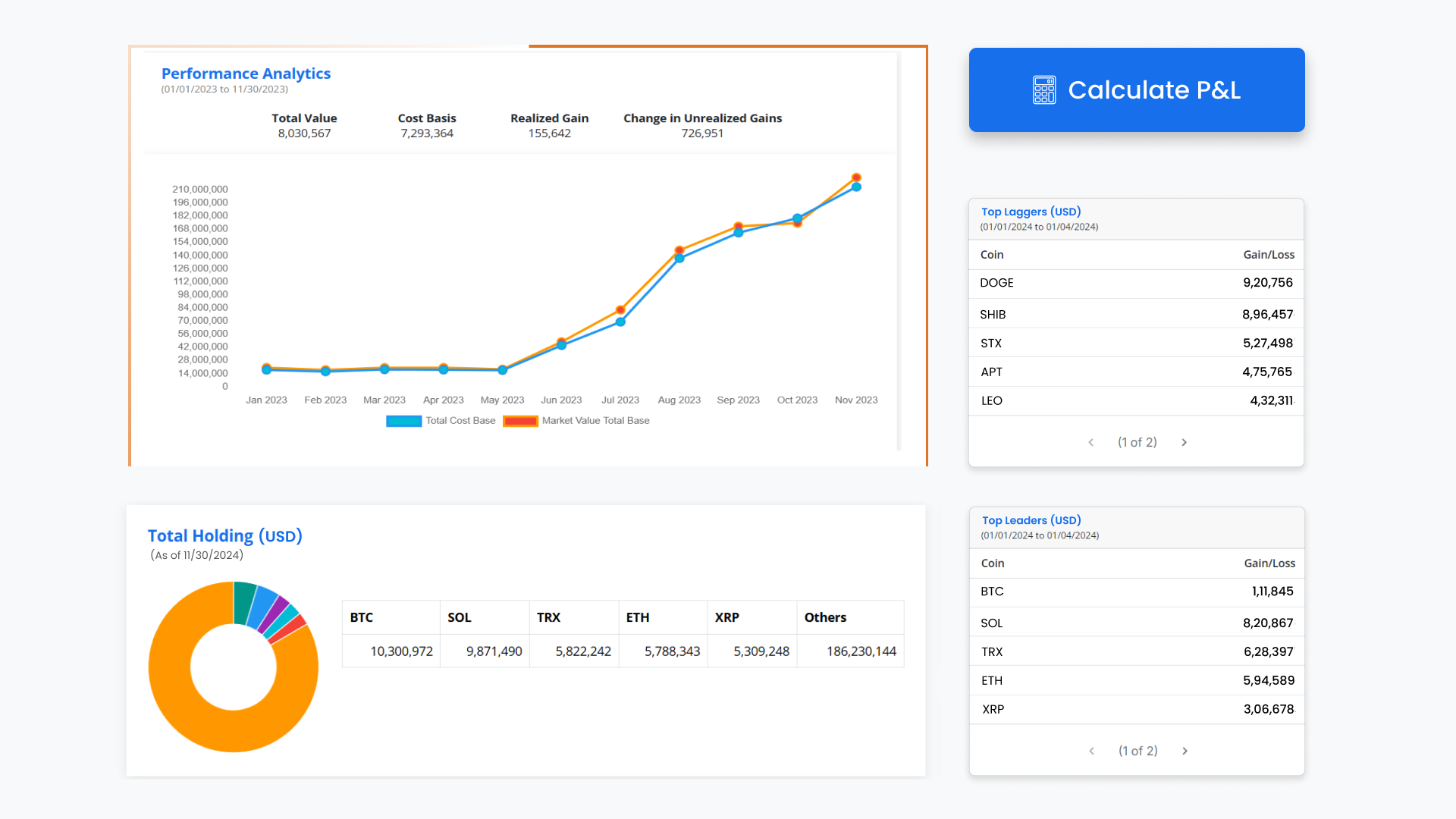

- Track short-term and long-term gains/losses at fingertips.

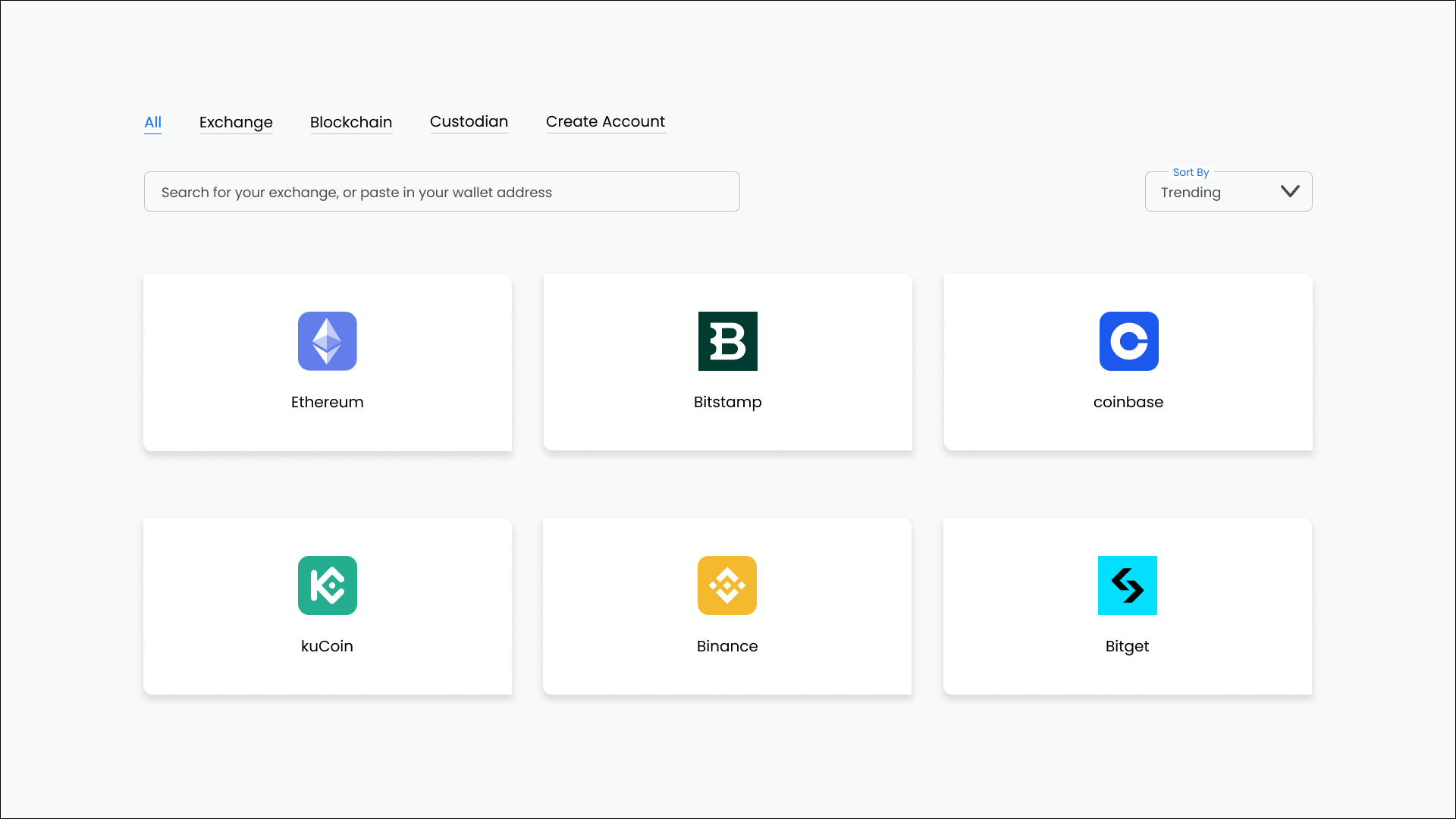

- Seamlessly connect to exchanges, wallets, DeFi platforms, and other protocols.

- Choose flexible tax methods: HIFO, FIFO, LIFO, and more.

- Handles complex transactions like margin trading, staking, and more.